44 coupon rate and yield to maturity

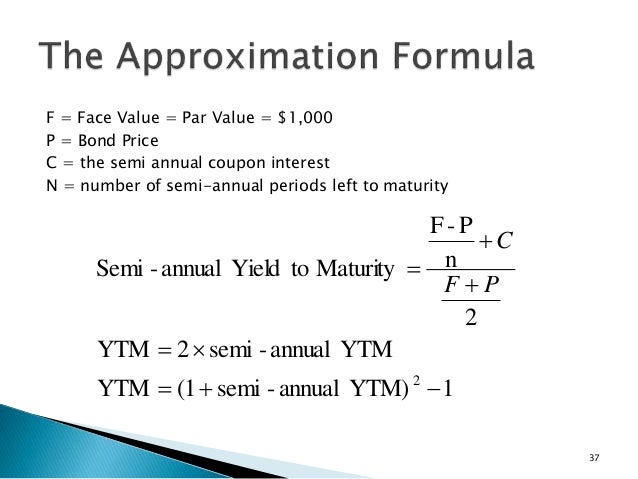

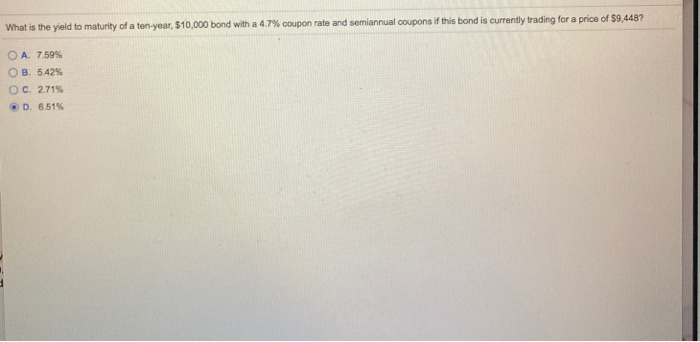

Difference Between Coupon Rate and Yield of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion Coupon Rate - Meaning, Calculation and Importance - Scripbox However, the assumption is that the investor holds the bond to maturity, and all the coupon payments are reinvested at the same rate. Yield to Maturity (YTM) = { (C) + [ (FV - PV) ÷ t]} ÷ [ (FV + PV) ÷ 2] Where, C - Coupon Payment FV - Face value of the bond PV - Current price of the bond t - no. of years to maturity

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Coupon rate and yield to maturity

› ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Jul 15, 2022 · Yield to maturity (YTM) is an important metric used in bond markets that describes the total rate of return that is expected from a bond once it has made all of its future interest payments and ... Yield to Maturity Calculator - Calculate YTM for Bonds Calculate the yield to maturity for a bond using our YTM calculator. Plus, calculate the current yield and see the yield to maturity formula. ... Annual Coupon Rate: % Years to Maturity: Coupon Frequency: ... Yield to Maturity Formula for Zero-Coupon Bonds ; Zero-Coupon (Discount) Bond YTM Formula ; By. Andrew Paniello. › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? If an investor purchases a bond at par or face value, the yield to maturity is equal to its coupon rate. If the investor purchases the bond at a discount, its yield to maturity will be higher than...

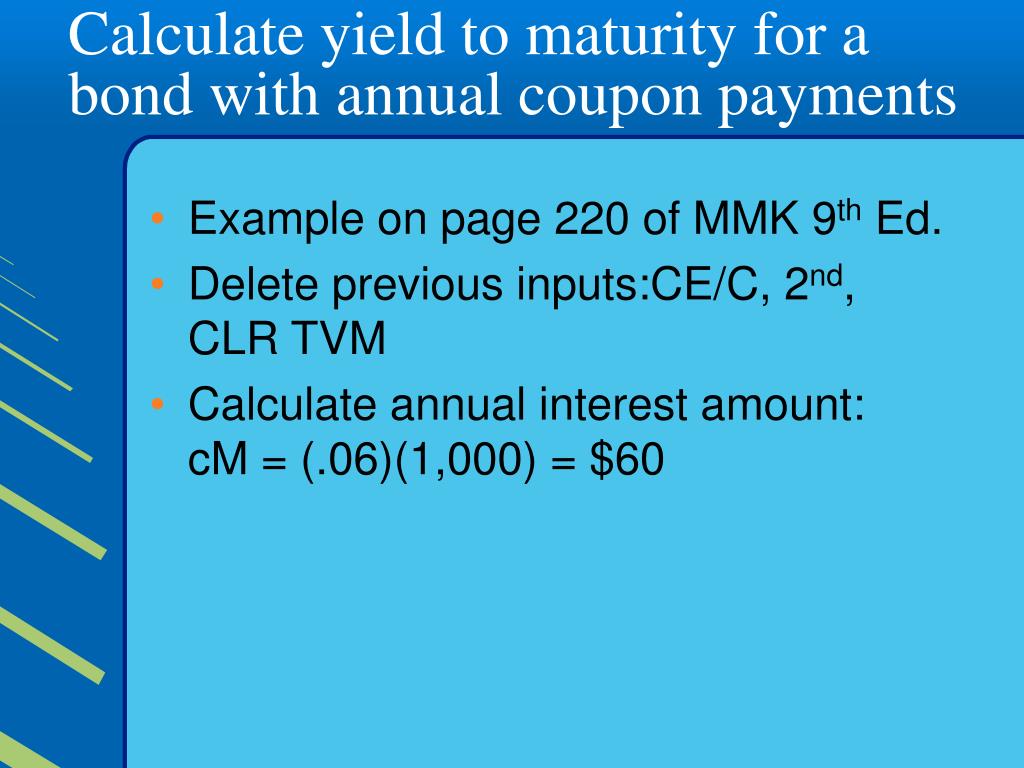

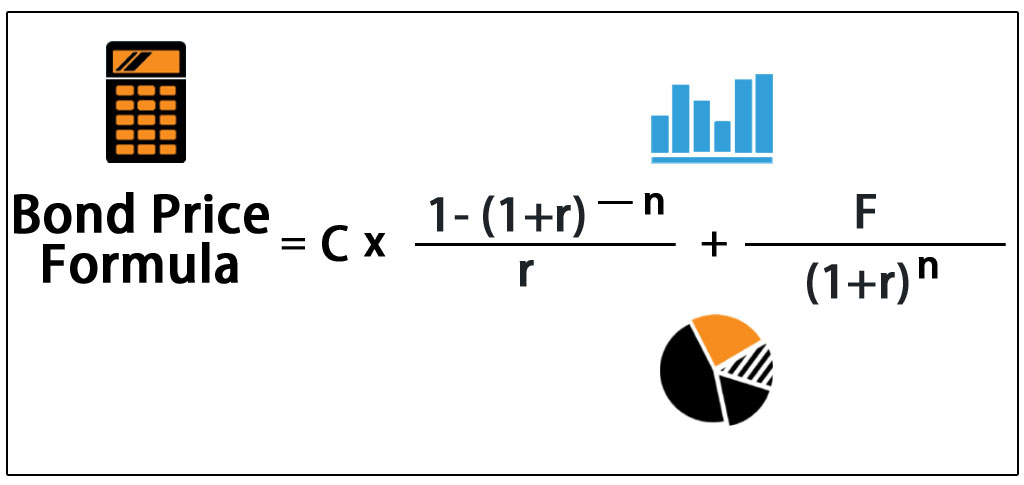

Coupon rate and yield to maturity. scripbox.com › mf › yield-to-maturityYield to Maturity (YTM) - Meaning, Formula & Calculation Sep 15, 2020 · Coupon rate. The coupon rate is the interest rate paid to the bondholder by the bond issuer. The coupon rate is paid on the bond’s face value and not on the market value. Interest rate. The interest rate of a bond is not the same as its coupon rate. Let’s understand this with an example. Mr Ananth buys a bond at INR 1,000 (face value), and ... Yield to Maturity Calculator | Good Calculators C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to Maturity? Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly. › the-difference-between-couponImportant Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. 1. Overview and Key Difference. Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate - YouTube The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return ... Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = 5-Year Treasury Yield + .05% So if the 5-Year Treasury Yield is 7%, then the coupon rate for this security will be 7.5%. Now, if this coupon is revised every six months and after six months, the 5-Year Treasury Yield is 6.5%, then the revised coupon rate will be 7%. › ask › answersWhen is a bond's coupon rate and yield to maturity the same? Jan 13, 2022 · The entire calculation takes into account the coupon rate, current price of the bond, difference between price and face value, and time until maturity. Along with the spot rate, yield to maturity ...

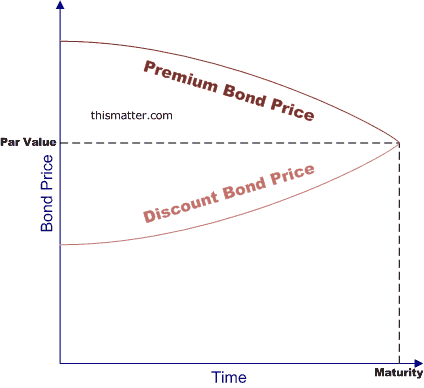

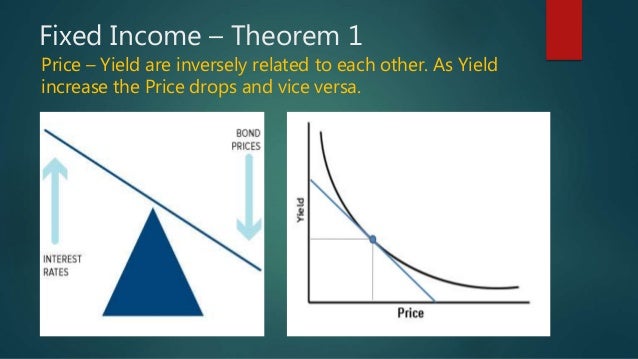

Bond Pricing - Formula, How to Calculate a Bond's Price Bond Pricing: Yield to Maturity. Bonds are priced to yield a certain return to investors. A bond that sells at a premium (where price is above par value) will have a yield to maturity that is lower than the coupon rate. Alternatively, the causality of the relationship between yield to maturity and price may be reversed. A bond could be sold at ... Coupon Rate Formula | Step by Step Calculation (with Examples) For example, if a bond with a face value of $1,000 offers a coupon rate of 5%, then the bond will pay $50 to the bondholder until its maturity. The annual interest payment will continue to remain $50 for the entire life of the bond until its maturity date irrespective of the rise or fall in the market value of the bond. en.wikipedia.org › wiki › Coupon_(finance)Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value . Bond Price Calculator Face/par value which is the amount of money the bond holder expects to receive from the issuer at the maturity date as agreed. Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly.

Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate. A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate. A bond is priced at a discount below par value when the coupon rate is less than the market discount rate.

Difference Between Coupon Rate and Yield to Maturity Coupon rate can be stated as the sum of money which a bond issuer has to pay relative to its bond value, while Yield to Maturity (YTM) can be defined as the total money which is to be accepted by an individual after the maturation. The coupon rate is also known as "Yield from the Bond.". This term is used to complicate things at some point ...

Current Yield vs. Yield to Maturity: What's the Difference? Yield to maturity is a way to compare bonds with different market prices, coupon rates, and maturities. Formula The current yield of a bond is easily calculated by dividing the coupon payment by the price. For example, a bond with a market price of $7,000 that pays $70 per year would have a current yield of 7%. 3

Coupon vs Yield | Top 8 Useful Differences (with Infographics) 3. Interest rates influence the coupon rates. The current yield compares the coupon rate to the market price of the bond. 4. The coupon amount remains the same until maturity. Market price keeps on fluctuating, better to buy a bond at a discount which represents a larger share of the purchase price. 5.

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

› ask › answersBond Yield Rate vs. Coupon Rate: What's the Difference? Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

Solved The yield to maturity of a $1,000 bond with a | Chegg.com coupon rate, semiannual coupons, and two years to maturity is 7.9% APR, compounded semiannually. What is its price? Part 1 The price of the bond is (Round to the nearest cent.) Question:The yield to maturity of a $1,000 bond with a 7.1% coupon rate, semiannual coupons, and two years to maturity is 7.9% APR, compounded semiannually. What is

Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Coupon rate is a fixed value in relation to the face value of a bond. If yield to maturity is greater than the coupon rate, the bond is trading at a discount to its par value.

Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? If an investor purchases a bond at par or face value, the yield to maturity is equal to its coupon rate. If the investor purchases the bond at a discount, its yield to maturity will be higher than...

Yield to Maturity Calculator - Calculate YTM for Bonds Calculate the yield to maturity for a bond using our YTM calculator. Plus, calculate the current yield and see the yield to maturity formula. ... Annual Coupon Rate: % Years to Maturity: Coupon Frequency: ... Yield to Maturity Formula for Zero-Coupon Bonds ; Zero-Coupon (Discount) Bond YTM Formula ; By. Andrew Paniello.

› ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Jul 15, 2022 · Yield to maturity (YTM) is an important metric used in bond markets that describes the total rate of return that is expected from a bond once it has made all of its future interest payments and ...

/GettyImages-527870974-576029945f9b58f22eb93d7d.jpg)

Post a Comment for "44 coupon rate and yield to maturity"