44 relationship between coupon rate and ytm

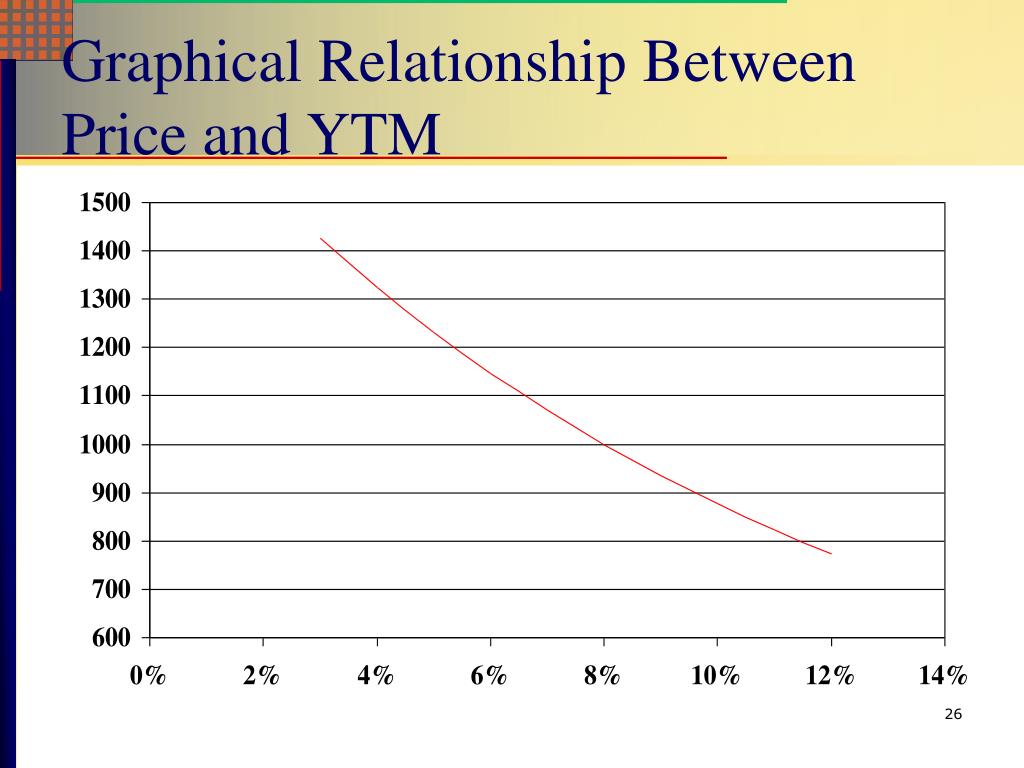

What is the difference between YTM and coupon rate? The YTM calculation takes into account: coupon rate, the price of the bond, time remaining until maturity, and the difference between the face value and the price. It is a rather complex calculation. The coupon rate, or, more simply stated, coupon of a particular bond, is the amount of interest paid every year. Is coupon rate annual or semi annual? What is the relationship between the yield of a bond and price of the ... So a rise in price will decrease the yield and a fall in the bond price will increase the yield. The calculation for YTM is based on the coupon rate, the length of time to maturity and the market price of the bond. YTM is basically the Internal Rate of Return on the bond. The Ceteris Paribus Assumption - A Level and IB Economics.

Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A...

Relationship between coupon rate and ytm

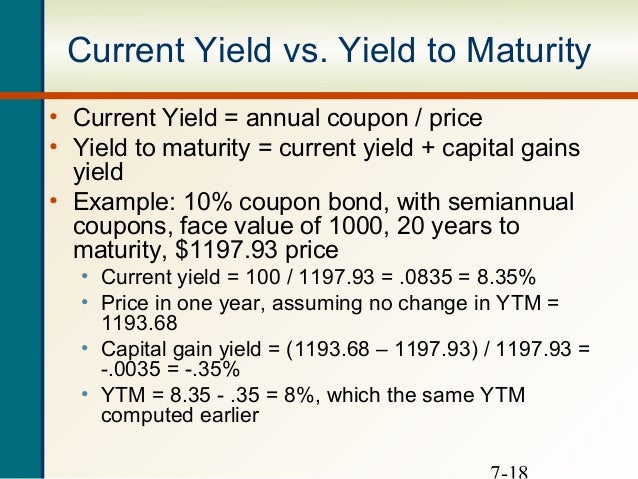

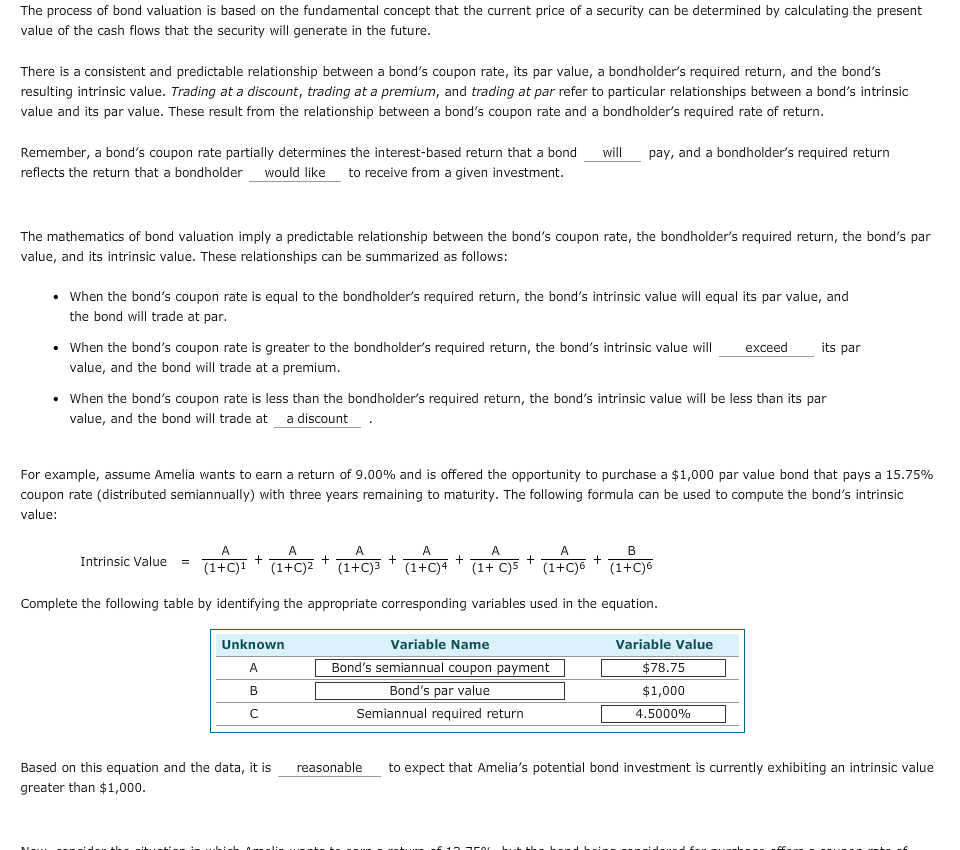

Coupon vs Yield | Top 5 Differences (with Infographics) The way the coupon rate is calculated is by dividing the annual coupon payment by the face value of the bond. In this case, the coupon rate for the bond will be $40/$1000, which is a 4% annual rate. It can be paid quarterly, semi-annually, or yearly depending on the bond. The Relationship Between a Bond's Price & Yield to Maturity That's because your yield to maturity at the time you buy the bond is based on receiving the full maturity value of the bond, typically $1,000. If you sell a bond before it comes due, you'll receive whatever the current market value is for your bond, which may be more or less than you paid. As a result, your yield to maturity will vary. Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

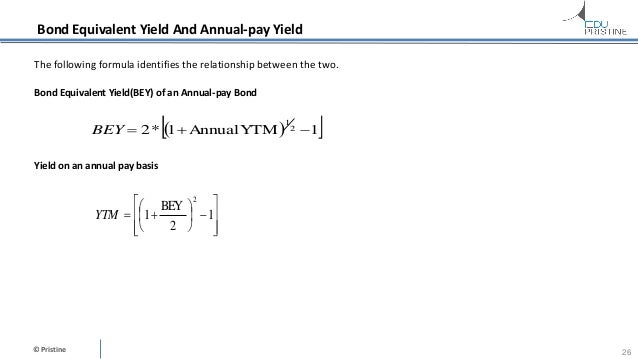

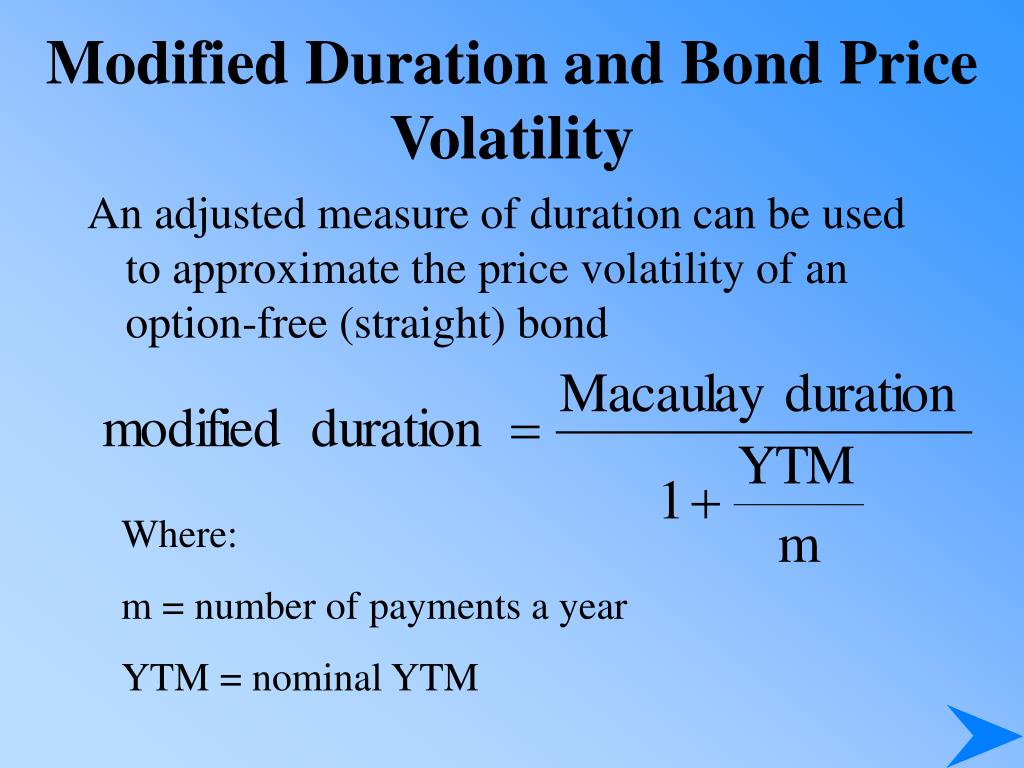

Relationship between coupon rate and ytm. The Relation of Interest Rate & Yield to Maturity - Pocketsense Interest payments are calculated on the par value of the bond, so always on that $100 or $1,000 per bond initial investment. A bond that pays 5 percent interest semiannually for six years would result in 12 payments of $2.50 per $100 of principal -- a total of $30 for the life of the bond. 00:00. 00:04 08:24. Difference Between YTM and Coupon rates 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author Recent Posts Ian Search DifferenceBetween.net : Help us improve. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Solved Calculate the yield to maturity (YTM) on this bond. | Chegg.com Question: Calculate the yield to maturity (YTM) on this bond. Explain the relationship that exists between the coupon interest rate and yield to maturity and the par value and market value of a bond. Kidd to maturity Each of the bonds shown in the following table pays interest annually. Calculate the yield to maturity (YTM) for cache bond.

Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) Here we provide you with the top 8 difference between Coupon Rate vs. Interest Rate. You are free to use ... Relationship : Bonds with lower fixed-rate coupons will have a higher ... which is the redemption amount at maturity. The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more will change ... Important Differences Between Coupon and Yield to Maturity Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%). Current Yield - Relationship Between Yield To Maturity and Coupon Rate Famous quotes containing the words relationship, yield, maturity and/or rate: " We must introduce a new balance in the relationship between the individual and the government—a balance that favors greater individual freedom and self-reliance. —Gerald R. Ford (b. 1913) " Never yield to that temptation, which, to most young men, is very strong, of exposing other people's weaknesses and ... Coupon Rate - Meaning, Calculation and Importance - Scripbox The main distinction between the coupon rate and YTM is the return estimation. The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond. Let's assume the couponrate for a bond is 15%.

Relationship Between Coupon and Yield - Assignment Worker Coupon rate = 14%, semiannual coupons YTM = 16% Maturity = 7 years Par value = $1,000 Slide 14 6-14 Example 7.1 • Semiannual coupon = $70 • Semiannual yield = 8% • Periods to maturity = 14 • Bond value = • 70 [1 - 1/ (1.08)14] / .08 + 1000 / (1.08)14 = 917.56 ( ) ( )2t 2t 2 YTM1 F 2 YTM 2 YTM1 1 -1 2 C Value Bond + + + = Difference Between Coupon Rate and Yield of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion What is the relationship between YTM and the discount rate of a bond? The Coupon Rate is 9%. It pays $90 per year since it was issued $90 is 9% of the original $1000 investment. The Bond Yield (aka, Current Yield) is 10%. 10% is your return this year, if you buy the bond at today's prices $90 is 10% of your $910 investment. The Yield to Maturity (YTM) is 13%. It's the only number that really matters. (Solved) - What is the relationship between the current yield and YTM ... When YTM is the same as the ...

Solved Describe the relationship between the coupon rate and | Chegg.com Question: Describe the relationship between the coupon rate and the yield to maturity when a bond is issued. Also comment on the general relationship between bond prices and interest rates. The response should include descriptions of the bond value when the coupon rate is higher than the yield to maturity, lower than the yield to maturity, and ...

What relationship between a bond's coupon rate and a bond's yield would ... If the coupon rate is above the market rate for similarly risky bonds, then you will have to pay more for the bond, because everyone else will want to bid on that bond as well. By paying more for the bond, you have reduced its effective yield down to the market rate of interest. No free lunch. Uttam K. Gulshan

Current Yield vs. Yield to Maturity - Investopedia When a bond's market price is above par, which is known as a premium bond, its current yield and YTM are lower than its coupon rate. Conversely, when a bond sells for less than par, which is known...

Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate.

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

The Relationship Between a Bond's Price & Yield to Maturity That's because your yield to maturity at the time you buy the bond is based on receiving the full maturity value of the bond, typically $1,000. If you sell a bond before it comes due, you'll receive whatever the current market value is for your bond, which may be more or less than you paid. As a result, your yield to maturity will vary.

Coupon vs Yield | Top 5 Differences (with Infographics) The way the coupon rate is calculated is by dividing the annual coupon payment by the face value of the bond. In this case, the coupon rate for the bond will be $40/$1000, which is a 4% annual rate. It can be paid quarterly, semi-annually, or yearly depending on the bond.

:max_bytes(150000):strip_icc()/BareYTMFormula-5d34698cfb7141d994781ca0fd54e332.jpg)

Post a Comment for "44 relationship between coupon rate and ytm"