42 how to calculate coupon rate from yield

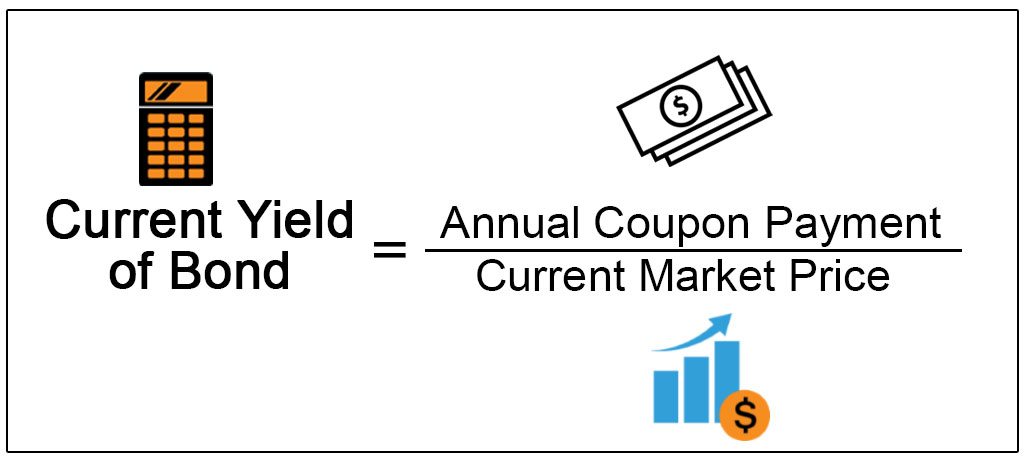

Current Yield Formula | Calculator (Examples with Excel Template) - EDUCBA Current Yield of a Bond can be calculated using the formula given below Current Yield = Annual Coupon Payment / Current Market Price of Bond Current Yield = $60 / $1,010 Current Yield = 5.94% Therefore, the current yield of the bond is 5.94%. Current Yield Formula - Example #3 Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return ...

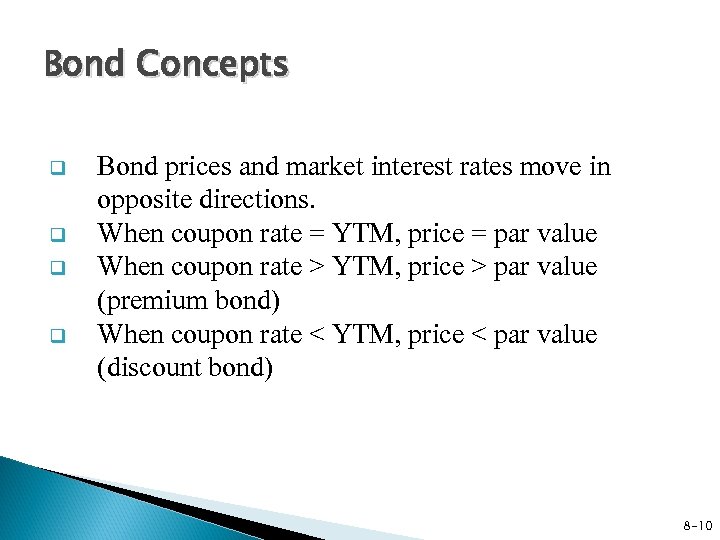

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo The coupon rate remains fixed for the entire duration of a bond as the coupon payment is fixed, and also the face value is fixed. Yield changes with the change in the market price of a bond. Effect of interest rate. Change in the interest rate in the economy by the central bank has no effect on the coupon rate of a bond.

How to calculate coupon rate from yield

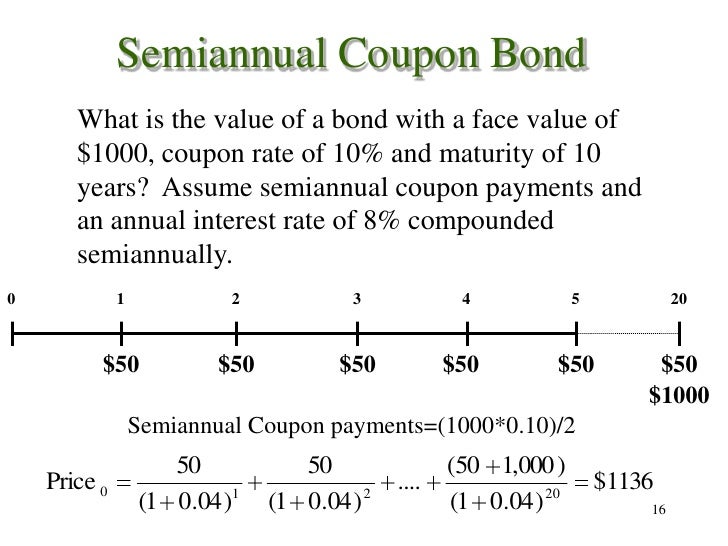

How to Calculate Current Yield (Formula and Examples) Below is an example of how to calculate current yield: John purchased a bond for $20,000, which has an annual coupon rate of 20%. The market price of the bond is $18,200. His coupon amount is 20% x $20,000 = $4,000. To calculate the current yield, he can use the following formula: Current yield = annual coupon interest / bond price. Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter When we aim to get a zero coupon bond price calculator semi-annual, the easy way is to have the coupon rate on the bond and then divide it by the present price of the bond to obtain yield. As coupon rates are fixed in terms of yearly interest payments, that's why it is necessary to divide the rate by two, to have the semi-annual payment. What Is Coupon Rate and How Do You Calculate It? - Accounting Services For instance, a bond with a $1,000 face value and a 5% coupon rate is going to pay $50 in interest, even if the bond price climbs to $2,000, or conversely drops to $500. Current yield compares the coupon rate to the current market price of the bond. Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is ...

How to calculate coupon rate from yield. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Below are the steps to calculate the Coupon Rate of a bond: Step 1: In the first step, the amount required to be raised through bonds is decided by the company, then based on the target investors (i.e. retail or institutional or both) and other parameters face value ... Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. How to Calculate Yield to Call (With Definition and Example) Assuming the bond issuer pays a coupon rate of 10% annually, multiply it by the bond's face value, which is $1,000, to find the coupon payment. Considering that 10% is 10/100, you can multiply it by $1,000 to get an annual coupon payment of $100. $900 = (100 / 2) x { (1 - (1 + YTC / 2) ^ -2t) / (YTC / 2)} + (CP / (1 + YTC / 2) ^ 2t) Bond Yield Formula | Step by Step Calculation & Examples - WallStreetMojo Annual Coupon Payment = Face Value * Coupon Rate =$1300*6% Annual Coupon Payment =$78 Step 2: Calculation of bond yield Bond Yield = Annual Coupon Payment/Bond Price =$78/$1600 Bond Yield will be - =0.04875 we have considered in percentages by multiplying with 100's =0.048*100 Bond Yield =4.875%

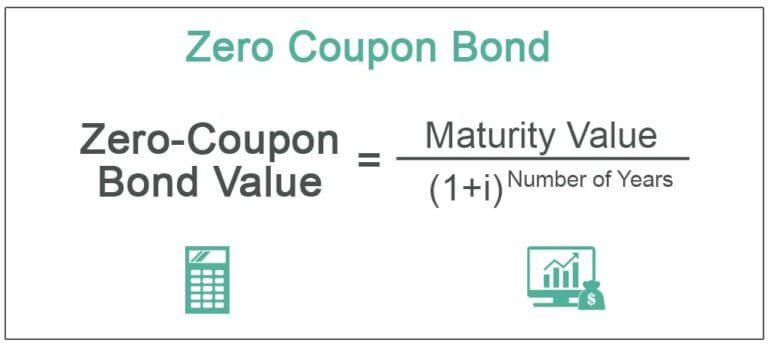

Effective Yield - Overview, Formula, Example, and Bond Equivalent Yield Effective Yield = [1 + (i/n)] n - 1 Where: i - The nominal interest rate on the bond n - The number of coupon payments received in each year Practical Example Assume that you purchase a bond with a nominal coupon rate of 7%. Coupon payments are received, as is common with many bonds, twice a year. Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Bootstrapping | How to Construct a Zero Coupon Yield Curve in Excel? Zero-Coupon Rate for 2 Years = 4.25%. Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25%. Conclusion. The bootstrap examples give an insight into how zero rates are calculated for the pricing of bonds and other financial products. One must correctly look at the market conventions for proper calculation of the zero ... Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

Yield to Maturity (YTM) - Overview, Formula, and Importance What is the Yield to Maturity (YTM)? Yield to Maturity (YTM) - otherwise referred to as redemption or book yield - is the speculative rate of return or interest rate of a fixed-rate security, such as a bond.The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the security has matured (reached its full value ... Coupon Rate Formula | Simple-Accounting.org A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year. Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly. What Is Coupon Rate and How Do You Calculate It? - Accounting Services For instance, a bond with a $1,000 face value and a 5% coupon rate is going to pay $50 in interest, even if the bond price climbs to $2,000, or conversely drops to $500. Current yield compares the coupon rate to the current market price of the bond. Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is ...

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter When we aim to get a zero coupon bond price calculator semi-annual, the easy way is to have the coupon rate on the bond and then divide it by the present price of the bond to obtain yield. As coupon rates are fixed in terms of yearly interest payments, that's why it is necessary to divide the rate by two, to have the semi-annual payment.

How to Calculate Current Yield (Formula and Examples) Below is an example of how to calculate current yield: John purchased a bond for $20,000, which has an annual coupon rate of 20%. The market price of the bond is $18,200. His coupon amount is 20% x $20,000 = $4,000. To calculate the current yield, he can use the following formula: Current yield = annual coupon interest / bond price.

![Calculate fixed amount before tax calculation [#1612662] | Drupal.org](https://www.drupal.org/files/fixed-coupon.jpg)

Post a Comment for "42 how to calculate coupon rate from yield"