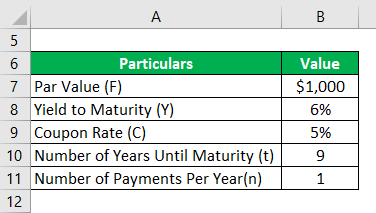

43 how to calculate a bond's coupon rate

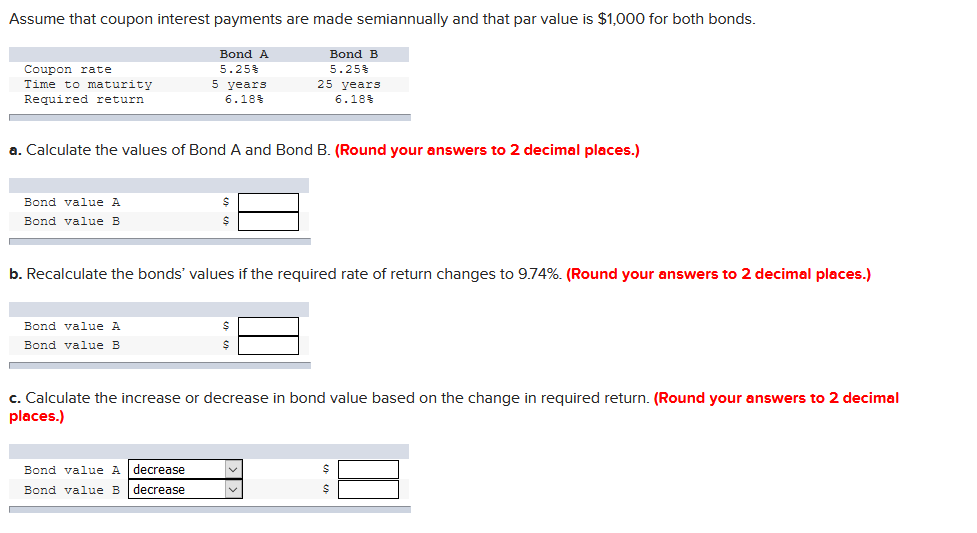

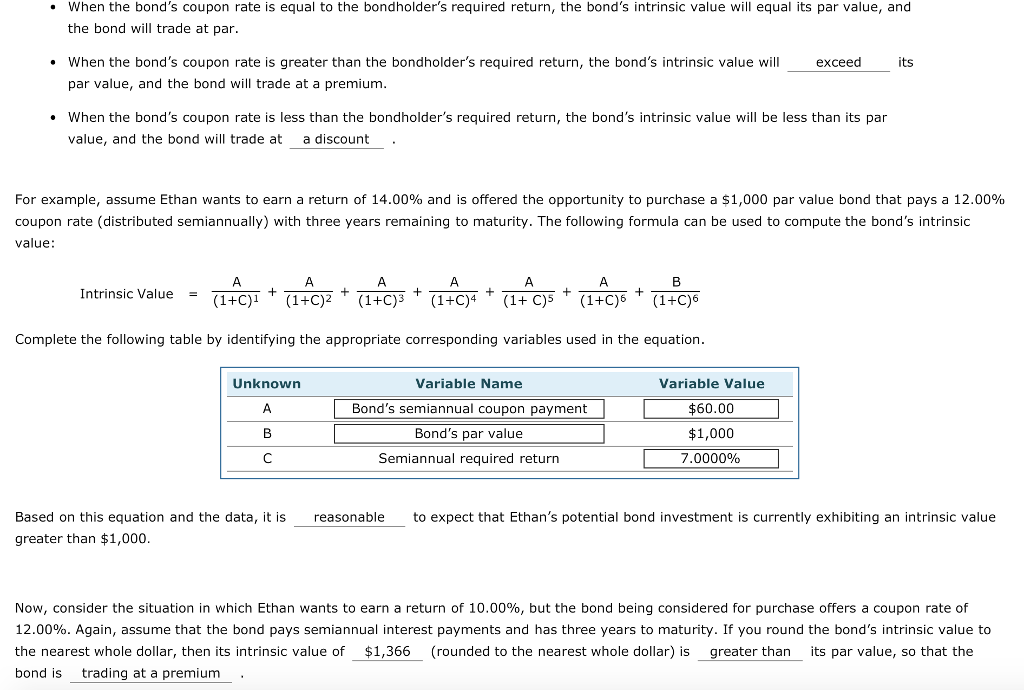

Bond Pricing Formula | How to Calculate Bond Price? | Examples where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and; n = No. of periods till maturity; On the other, the bond valuation formula for deep discount bonds or zero-coupon bonds Zero-coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to ... How to Calculate Bond Discount Rate: 14 Steps (with Pictures) Jul 22, 2022 · For this calculation, you need to know the bond's annual coupon rate and the annual market interest rate. Also, find out the number of interest payments per year and the total number of coupon payments. Using the example above, the annual coupon rate is 10 percent and the annual current market interest rate is 12 percent.

PPIC Statewide Survey: Californians and Their Government Oct 27, 2022 · Seventy-six percent rate the nation’s economy as “not so good” or “poor.” Thirty-nine percent say their finances are “worse off” today than a year ago. Forty-seven percent say that things in California are going in the right direction, while 33 percent think things in the US are going in the right direction; partisans differ in ...

How to calculate a bond's coupon rate

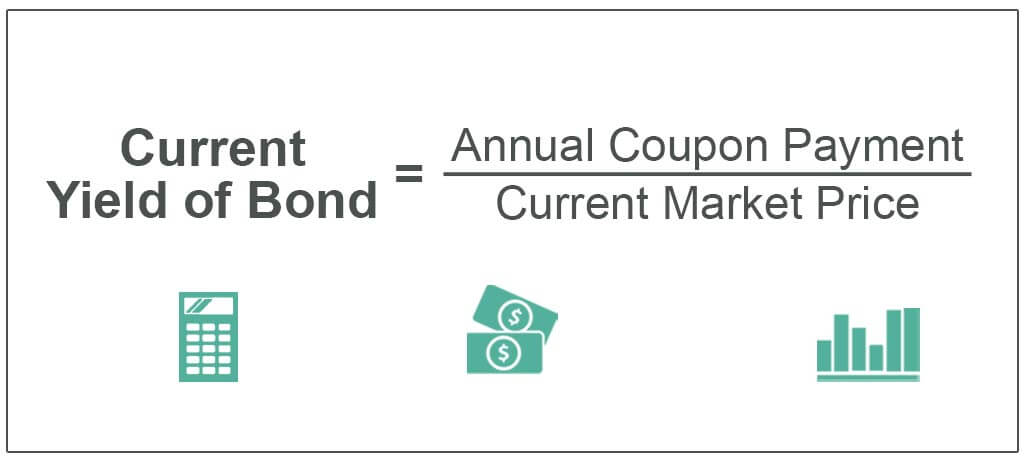

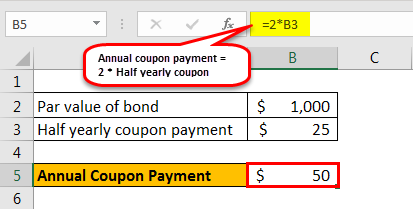

How to Calculate an Interest Payment on a Bond: 8 Steps - wikiHow Dec 10, 2021 · By knowing a bond's maturity, you can also understand the length of a bond's term. Some bonds for example are 10 years in length, others are 1 year, and some are as long as 40 years. Coupon. A coupon can be thought of as a bond's interest payment. A bond's coupon is typically expressed as a percentage of the bond's face value. Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... When is a bond's coupon rate and yield to maturity the same? Jan 13, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ...

How to calculate a bond's coupon rate. How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia Jul 28, 2022 · A bond's coupon rate is simply the rate of interest it pays each year, expressed as a percentage of the bond's par value. (It's called the coupon rate because, in days of yore, investors actually ... When is a bond's coupon rate and yield to maturity the same? Jan 13, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ... Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... How to Calculate an Interest Payment on a Bond: 8 Steps - wikiHow Dec 10, 2021 · By knowing a bond's maturity, you can also understand the length of a bond's term. Some bonds for example are 10 years in length, others are 1 year, and some are as long as 40 years. Coupon. A coupon can be thought of as a bond's interest payment. A bond's coupon is typically expressed as a percentage of the bond's face value.

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "43 how to calculate a bond's coupon rate"