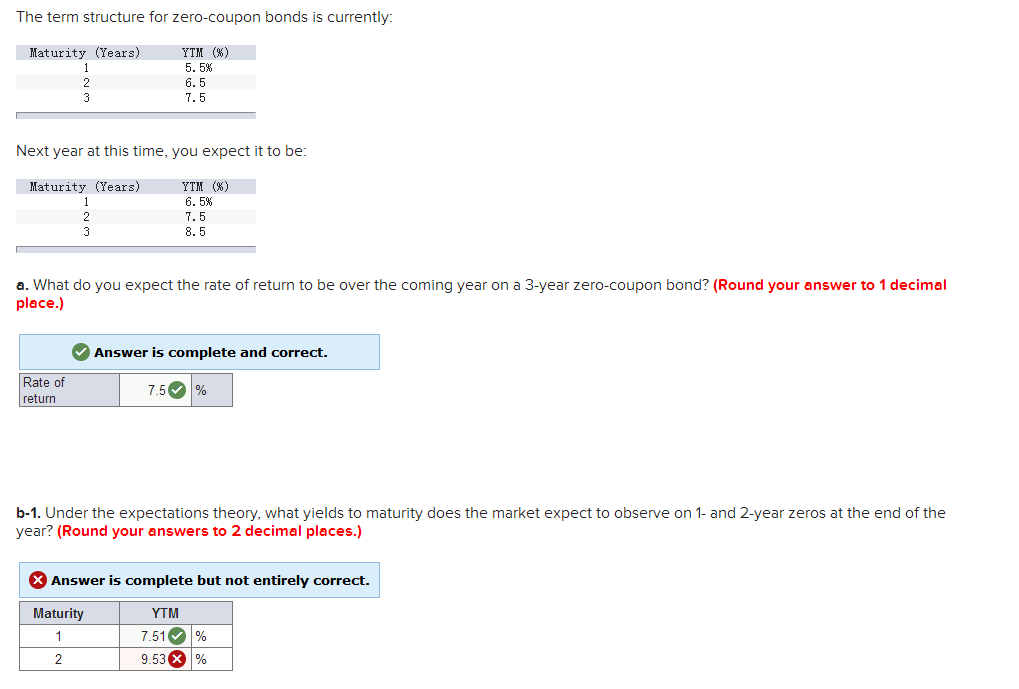

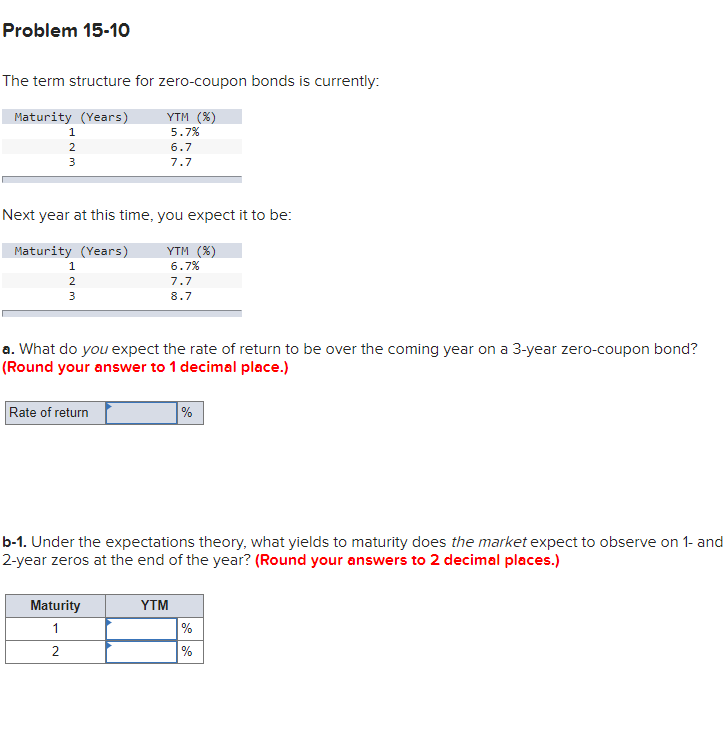

42 ytm for zero coupon bond

Imputed Interest Definition - Investopedia Apr 25, 2022 · Imputed interest is used by the Internal Revenue Service (IRS) as a means of collecting tax revenues on loans or securities that pay little or no interest. Imputed interest is important for ... Bond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

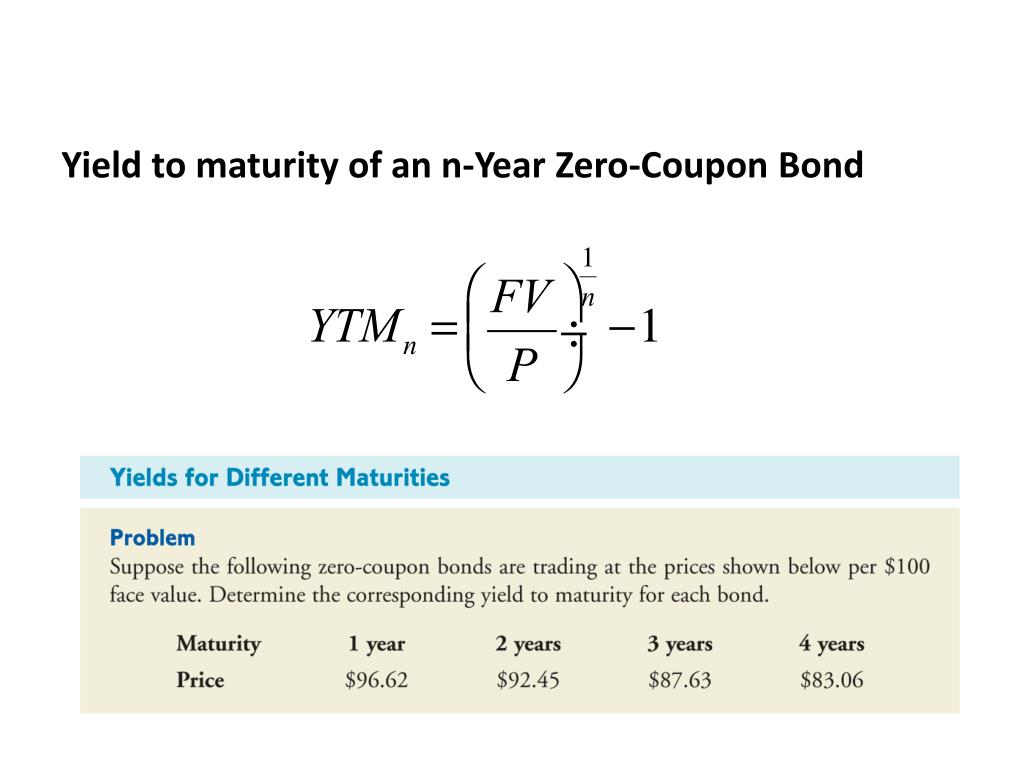

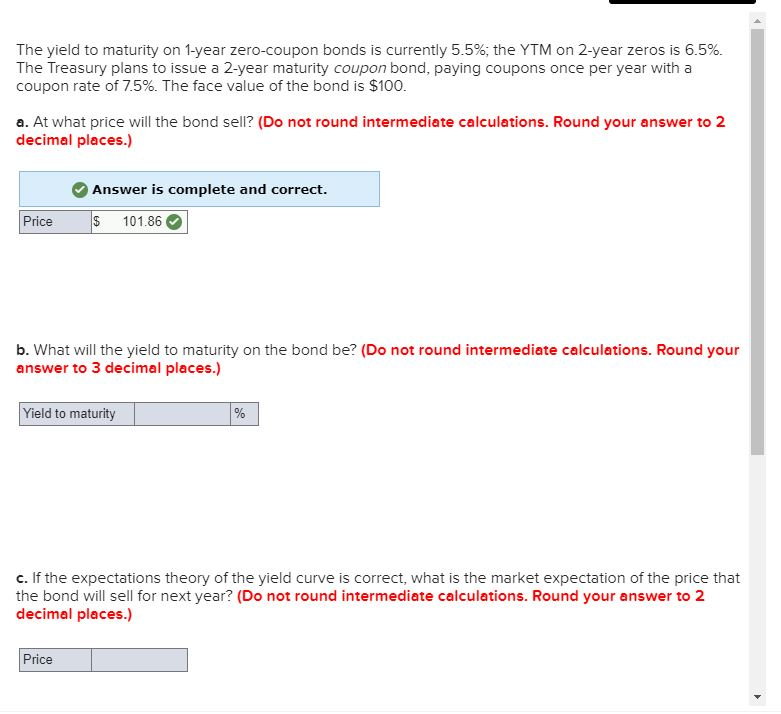

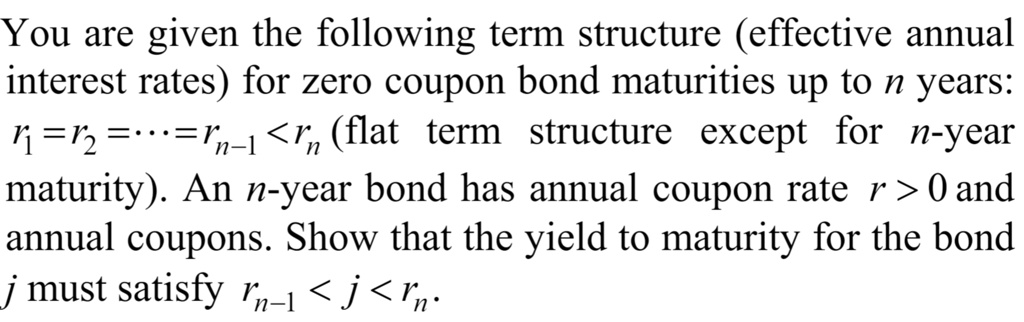

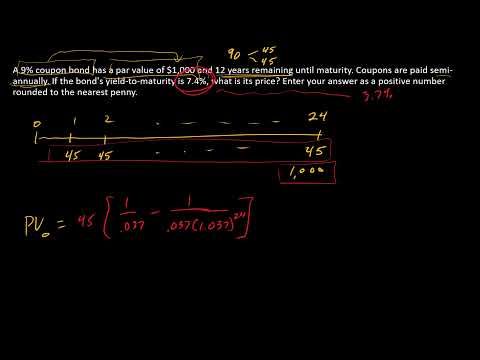

Yield to Maturity (YTM): Formula and Ratio Calculation In our hypothetical scenario, the following assumptions regarding the bond will be used to calculate the yield-to-maturity (YTM). Face Value of Bond (FV) = $1,000; Annual Coupon Rate (%) = 6.0%; Number of Years to Maturity = 10 Years; Price of Bond (PV) = $1,050; We’ll also assume that the bond issues semi-annual coupon payments. Step 2.

Ytm for zero coupon bond

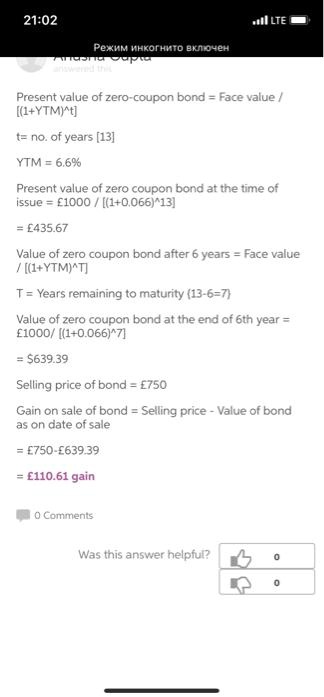

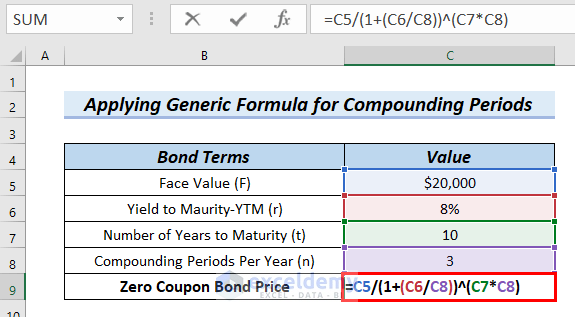

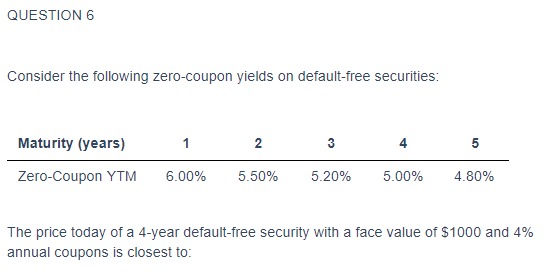

How to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity . The bond is currently valued at $925, the price at which it could be purchased today. Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Yield to maturity - Wikipedia Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds [ edit ] For bonds with multiple coupons, it is not generally possible to solve for yield in terms of price algebraically.

Ytm for zero coupon bond. Yield to Maturity Formula & Examples | How to Calculate YTM ... Dec 16, 2021 · It is much simpler to determine YTM for zero-coupon bonds. Here is the formula an investor would use to calculate zero-coupon bonds: ... Here is an example of a $100 zero-coupon bond with a two ... Yield to maturity - Wikipedia Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds [ edit ] For bonds with multiple coupons, it is not generally possible to solve for yield in terms of price algebraically. Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... How to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity . The bond is currently valued at $925, the price at which it could be purchased today.

Post a Comment for "42 ytm for zero coupon bond"