43 zero coupon bonds tax

What is a Zero Coupon Bond? Who Should Invest? | Scripbox Zero coupon bonds are fixed income securities that don't pay any interest. At the time of maturity, the investor is paid the face value or par value. These bonds come with 10-15 years maturity.Hence, they trade at a deep discount. The bond pricing varies with time to maturity.. The higher the time until maturity, lower will be the price the investor will be willing to pay. Understanding Zero Coupon Bonds - Part One - The Balance You buy zero coupon bonds a deep discount to face value. You receive no interest until maturity; however, in most cases, you do owe taxes annually on the interest as it accrues. In Part Two In part two, we'll look more closely at the tax implications of zero coupon bonds and examine how you can use zeros to meet your financial goals.

Zero-Coupon Bonds: Characteristics and Calculation Example Zero-coupon bonds, also known as "discount bonds," are sold by the issuer at a price lower than the face (par) value that is repaid at maturity. Zero-coupon bonds are debt obligations structured without any required interest payments (i.e. "coupons") during the lending period, as implied by the name. Instead, the difference between the ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Zero coupon bonds tax

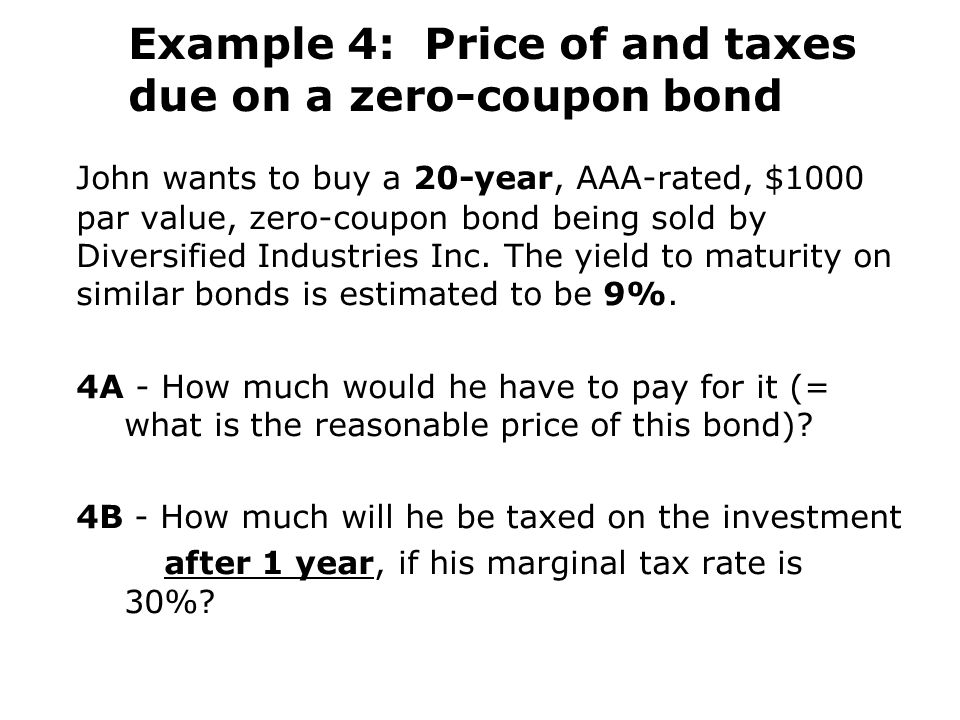

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. Tax Considerations for Zero Coupon Bonds - Financial Web With a zero coupon bond, you are not paid any interest over the life of the bond. At the end of the bond, you get the face value of the bond. The difference with this type of bond is that you can buy the bond at a serious discount to what its end value is. For example, you may only pay 70 to 80 percent of the value of the bond when you buy it. Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price = M / (1+r)n. where: M = maturity value or face value of the bond. r = rate of interest required. n = number of years to maturity. 3.

Zero coupon bonds tax. Zero Coupon Municipal Bonds: Tax Treatment - TheStreet The question concerns tax-exempt zero-coupon municipal bonds. A regular bond pays interest on its face value, or principal, twice a year at a rate determined by its coupon. A bond... Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Zero-Coupon Bonds - Tax Professionals Member Article By Carmen Garcia The downside of zero-coupon bonds is that they may not offer the investor as many benefits, such as a higher return on investment and tax benefits. These types of bonds also have a higher risk because there is no income over their useful life. Impact of Taxation on Zero-Coupon Muni Returns - MunicipalBonds.com Tax risk: Although there are no interest payments made on zero-coupon bonds, investors may still be subject to the tax implications for the accrued interest part on the bond value for each year. This can be avoided by investing in zero-coupon munis. Do read due diligence on muni bonds to have a better understanding of the regulatory framework.

How to Invest in Zero-Coupon Bonds - US News & World Report The problem can be avoided with a tax-free municipal zero-coupon bond, or by holding the zero in a tax-preferred account like an individual retirement account. Volatility is a second issue. How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond doesn't pay interest, but it could pay off for your portfolio. Choosing between the many different types of bonds may require a plan for your broader investments. A zero coupon bond often requires less money up front than other bonds. Yet zero coupon bonds still carry some of risk and can still be influenced by interest rates. How Do I Buy Zero Coupon Bonds? | Budgeting Money - The Nest Step 2. Buy the bonds through a tax-deferred retirement account to defer the income taxes on the interest income. Although you do not receive the interest on zero coupon bonds directly each year, you can still be taxed on the "phantom" interest that accrues each year. If you purchase the bonds through a retirement account, you'll only pay ... Are Bonds Taxable? 2022 Rates, Types of Bonds, Tax-Minimizing Tips With a zero-coupon bond, you buy the bond at a discount from its face value, don't receive interest payments during the bond's term, and are paid the bond's face amount when it matures....

What Is a Zero-Coupon Bond? - Investopedia The imputed interest on the bond is subject to income tax, according to the Internal Revenue Service (IRS). Therefore, although no coupon payments are made on zero-coupon bonds until... Zero Coupon Bonds: Know tax rules when such a bond is held till ... Thus, taxation of zero coupon bond merely depends upon the period of holding. When a zero coupon bond is sold in the secondary market which was originally purchased from the primary... 14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Figure 14.9 December 31, Year One—Interest on Zero-Coupon Bond at 6 Percent Rate 3. The compounding of this interest raises the principal by $1,068 from $17,800 to $18,868. The balances to be reported in the financial statements at the end of Year One are as follows: Year One—Interest Expense (Income Statement) $1,068. How to Buy Zero Coupon Bonds | Finance - Zacks The bonds are issued at a minimum face value of $1,000, and the earliest a Treasury zero bond matures is in 10 years. The bond interest income is taxed at the federal level and possibly at...

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will...

Section 2(48) Income Tax: Zero Coupon Bonds - CA Club a) Meaning of 'Zero Coupon Bond': Section 2 (48) Income Tax As per Section 2 (48) of Income Tax Act, 1961, unless the context otherwise requires, the term "zero coupon bond" means a bond- (a) issued by any infrastructure capital company or infrastructure capital fund or public sector company or scheduled bank on or after the 1st day of June, 2005;

Zero-coupon bond - Wikipedia Alternatively, when a zero coupon bond issued by a US state or local government entity is purchased, the imputed interest is free of U.S. federal taxes and, in most cases, state and local taxes. Zero coupon bonds were first introduced in the 1960s but did not become popular until the 1980s.

How is tax calculated on a zero coupon bond? - Quora The brokerage firm calculates it annually—and reports it on your annual tax statement—by multiplying the cost of the bond ($900) by the Yield to Maturity (5.4%). So, on a 2-year, zero-coupon bond you bought for $900, the imputed interest for this year would be $50. You will pay tax on the $50, whether you actually made $50 or not.

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

Tax Considerations for Zero Coupon Bonds - m.finweb.com With a zero coupon bond, you are not paid any interest over the life of the bond. At the end of the bond, you get the face value of the bond. The difference with this type of bond is that you can buy the bond at a serious discount to what its end value is. For example, you may only pay 70 to 80 percent of the value of the bond when you buy it.

Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom What is the tax treatment for Zero Coupon Bonds? Zero coupon bonds that are notified and issued by REC and NABARD are taxable. Earnings from zero coupon bonds are also subject to capital gains tax at the time of maturity. The earnings or capital appreciation for zero coupon bonds is the difference between the maturity value and purchase price ...

Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 - TaxWink Unlike other bonds or debentures, investment in zero coupon bonds does not give any periodic return. Therefore, annual interest cannot be taxed on accrual basis in this case like other bonds or debentures. Under Income Tax Act, gains on sale of any securities shall be taxable as long term or short-term capital gains depending on the holding period.

Investor's Guide to Zero-Coupon Municipal Bonds Zero-coupon bonds are sold at a substantial discount from the face value. For example, a bond with a face value of $20,000, maturing in 20 years with a 5.5% coupon, may be purchased at issuance for roughly $6,757. At the end of the 20-year investment, the investor will receive the full $20,000 face value.

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price = M / (1+r)n. where: M = maturity value or face value of the bond. r = rate of interest required. n = number of years to maturity. 3.

Tax Considerations for Zero Coupon Bonds - Financial Web With a zero coupon bond, you are not paid any interest over the life of the bond. At the end of the bond, you get the face value of the bond. The difference with this type of bond is that you can buy the bond at a serious discount to what its end value is. For example, you may only pay 70 to 80 percent of the value of the bond when you buy it.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

:max_bytes(150000):strip_icc()/GettyImages-932585920-5c910a5846e0fb000172f0e8.jpg)

Post a Comment for "43 zero coupon bonds tax"